The Technology Sector:

The technology sector has shown impressive growth and dominance on the stock market, led by companies like Apple, Microsoft and Nvidia. Factors such as the rise of artificial intelligence (AI) and significant investments in research and development have contributed to the sector’s strong performance.

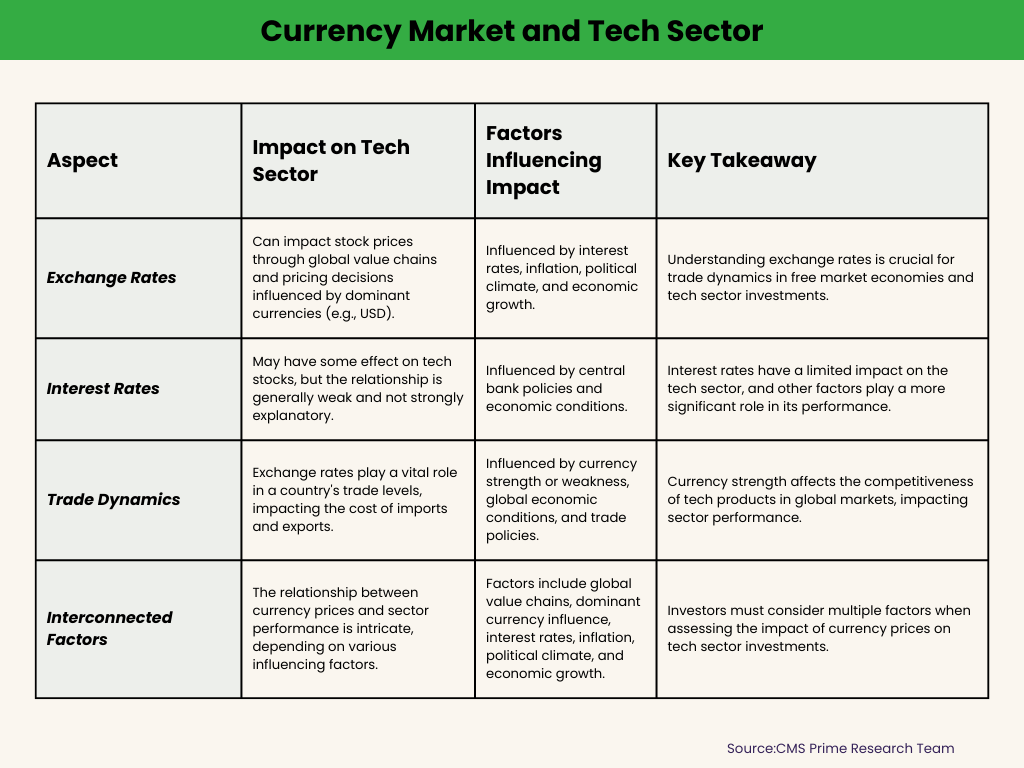

Understanding the relationship between currency values, specifically exchange rates and equity markets can be quite intricate. Exchange rates play a crucial role in determining a country’s level of trade, which is vital for most economies that follow free market principles. When a country’s currency value is higher, it makes imports cheaper while making exports more expensive in foreign markets. Conversely, when a currency value is lower, imports become more expensive while exports become more affordable abroad. Several factors influence exchange rates including interest rates, inflation levels, political conditions and economic growth.

Currency Impact and Tech Sector:

Within the context of the technology sector, exchange rates can impact stock prices through various channels such as global value chains and dominant currencies like the US dollar influencing pricing decisions made by companies. Additionally, interest rates can have some effect on tech stocks; however it should be noted that there is not a strong or clear explanatory relationship between interest rates and returns within this sector.

To put it simply, the connection between currency prices, equity markets and the technology sector is quite intricate and influenced by a range of factors. Having a good grasp of these interrelationships can assist investors in making well informed decisions regarding their investments in the technology sector.

The link between currency prices and sector performance can be rather intricate and differs based on the specific sector under consideration. In general, exchange rates play a crucial role in determining a country’s trade level, which holds significant importance for most free market economies. A stronger currency makes imports cheaper while making exports more expensive in foreign markets; conversely, a weaker currency has the opposite effect. Several factors such as interest rates, inflation, political climate and economic growth can influence exchange rates.

For instance, when it comes to the technology sector, the influence of exchange rates on stock prices can be shaped by various factors like global value chains and how dominant currencies like the US dollar influence pricing decisions made by firms. Additionally, interest rates may have an impact on tech stocks; however, it is worth noting that the relationship between interest rates and tech sector returns is generally weak and not particularly explanatory.

In summary, understanding the connection between currency prices and sector performance is complex due to its dependence on several influencing factors. Understanding these relationships can assist investors in making well informed decisions regarding their investments across various sectors.

The intricate relationship between currency values and sector performance is a dynamic and multifaceted phenomenon. This complexity arises from a myriad of factors, including exchange rates, interest rates, inflation, political conditions, and economic growth. While these elements collectively shape the performance of various sectors in the market, some industries are more sensitive to currency fluctuations than others.

Sectors Most Affected:

The sectors that experience the greatest impact from fluctuations in currency prices usually include those heavily involved in international trade, exposed to global commodity price changes or dependent on foreign capital. Some of these sectors encompass;

- Industries focused on exports: Companies relying extensively on exports are directly influenced by currency fluctuations. A stronger domestic currency can lead to increased prices for their products in foreign markets, potentially reducing demand and affecting revenues. Conversely, a weaker domestic currency can enhance competitiveness, driving up demand and revenues.

- Industries reliant on imports: Sectors depending on imported goods or raw materials are also significantly affected by changes in currency prices. A stronger domestic currency makes imports more affordable, lowering production costs; whereas weaker domestic currency increases import costs and raises production expenses.

- Industries tied to commodities; Sectors closely associated with commodity prices such as oil, gold or agricultural products can experience the effects of changes in currency prices.

For instance, the Canadian dollar (CAD) is influenced by oil prices due to exports, whereas Australia (AUD) and New Zealand (NZD) have a strong connection to both gold and oil prices.

- Tourism and travel: The tourism industry can be sensitive to currency fluctuations as a stronger domestic currency can make a country pricier for foreign tourists, while a weaker domestic currency can make it more appealing.

- Financial services: The financial sector is also impacted by changes in currency values since fluctuations in exchange rates can affect investment flows, capital markets and the overall value of financial assets.

It’s important to acknowledge that the relationship between currency values and sector performance is intricate and varies based on specific sectors and the factors influencing currency movements.

Conclusion:

In conclusion, the intricate relationship between currency values and sector performance is a dynamic and multifaceted phenomenon. This complexity arises from a myriad of factors, including exchange rates, interest rates, inflation, political conditions, and economic growth. While these elements collectively shape the performance of various sectors in the market, some industries are more sensitive to currency fluctuations than others.

Notably, the technology sector, led by giants like Apple, Microsoft, and Nvidia, exhibits a degree of resilience to currency-related influences. This resilience can be attributed to its global value chains, pricing decisions influenced by dominant currencies like the US dollar, and the fact that the relationship between interest rates and tech sector returns remains relatively weak and non-explanatory.

For investors seeking to navigate the intricate terrain of currency values and sector performance, it is imperative to recognize that different industries are impacted to varying degrees. Sectors heavily involved in international trade, reliant on imports or exports, or closely tied to commodity prices are among the most vulnerable to currency fluctuations. Moreover, industries like tourism, travel, and financial services are also significantly affected by changes in currency values.

In this ever-evolving landscape, a nuanced understanding of these interrelationships is essential for making well-informed investment decisions. Investors must carefully consider the specific sectors they are interested in, assess the prevailing economic conditions, and monitor currency movements to mitigate risks and capitalize on opportunities in the dynamic world of financial markets. Ultimately, the ability to navigate these complexities can lead to more successful and informed investment strategies across a wide range of sectors.

Disclaimer: This is not an Investment Advice. Investing and trading in currencies involve inherent risks. It’s essential to conduct thorough research and consider your risk tolerance before engaging in any financial activities.