XAU/USD in a Bearish range, waiting on US CPI news, strong range between 22.850 to 23.230 levels

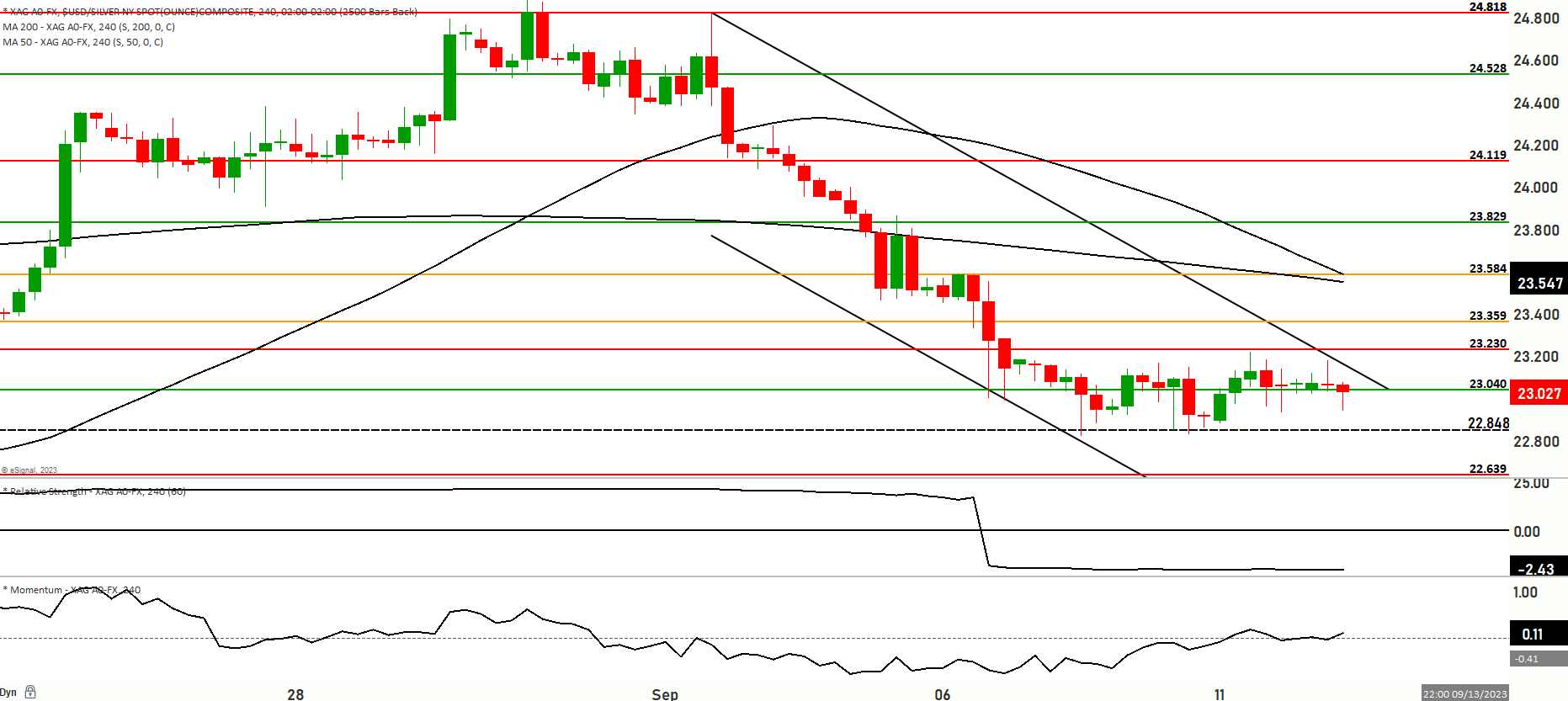

The current price of Silver shows a bearish sentiment within a defined range, with prices hovering around the $23.150 level. Notably, the price of silver is positioned below both the 50-day and 200-day Moving Averages, indicating a range-bound but overall bearish outlook.

Scenario 1 (Bearish Outlook):

In this scenario, there is a possibility that the price of silver may continue its downward trajectory. The first support levels to be mindful of are at $22.943 and $22.848. If these levels are successfully breached, the price could potentially decline further, testing the $22.748 level. A crucial support level to closely monitor in this scenario is at $22.639.

Scenario 2 (Bullish Outlook):

Conversely, there’s the potential for a price reversal, where silver could ascend from its current level. The initial resistance to observe is at $23.230. If this level is surpassed, the price may encounter further resistance around the $23.359 mark. Subsequent upward momentum could lead to a test of more significant resistance levels at $23.467 and $23.584, with the latter acting as a major uppermost resistance level.

Currently, the momentum for the silver market is bearish, suggesting a prevailing downward pressure on prices. Additionally, the Relative Strength Index (RSI) is in an oversold range, which can indicate that the market may be due for a potential rebound.

Key Levels to watch are 23.584,23.230,22.848,22.639

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 22.943 | 23.230 |

| Level 2 | 22.848 | 23.359 |

| Level 3 | 23.639 | 23.584 |