USD/JPY Regains Footing in Asian Session Amid Supportive Factors, possible retest to the 147 Level

In the Asian session, USD/JPY has found stability following an overnight decline, as bids reenter the market. Japanese importers are offering support to the pair, leading to a range between 145.81 and 146.25, particularly with the anticipation of an active month-end Tokyo fix due to increased importer demand during market downturns. US yields have also rebounded from their overnight lows, with Treasury 2s at 4.909% and 10s at 4.133%. The Nikkei’s 0.8% rise at 32,481 is attributed to offshore buying and hedging strategies. While BOJ Tamura’s hawkish comments, in contrast to Governor Ueda’s stance, have gone relatively unnoticed for now.

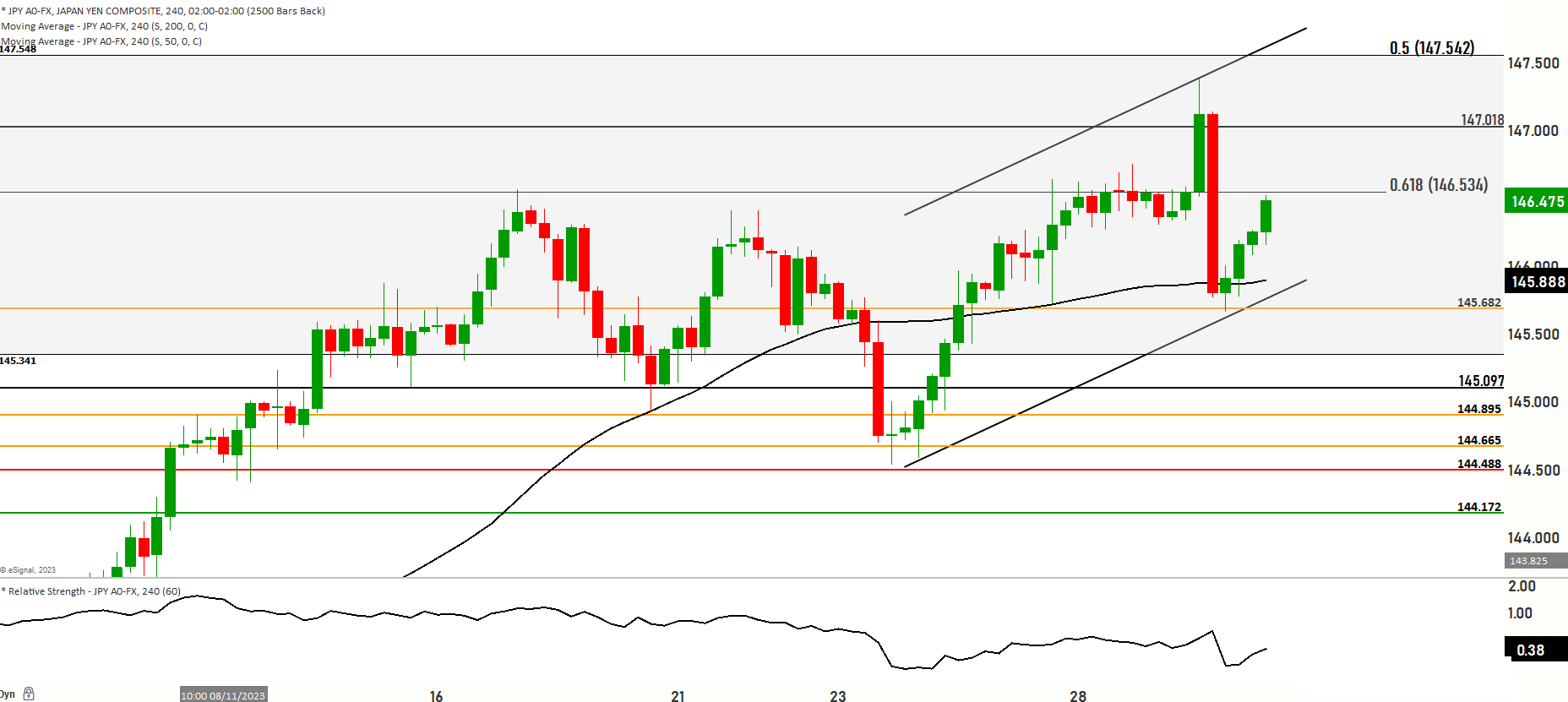

The current price of USD/JPY is trading around the 146.200 level and is being tested against the 200 and 50 Day Moving Averages, suggesting a prevailing bullish momentum.

Scenario 1: Bullish Continuation: If the bullish movement persists, the price might retest the 146.560 level. Further upward momentum could lead to an advance towards the 146.958 level, which coincides with the upper resistance level. The topmost resistance is situated at the 147.350 level.

Scenario 2: Bearish Correction: Conversely, if the price retraces, it may test the 145.867 level. A successful test at this level could trigger further downside movement towards the 145.682 level. Subsequent support levels include 145.433 and 145.097, with key levels to monitor at 145.097.

The current market momentum displays a bullish range, but a pullback from previous highs hints at an overbought market condition. Additionally, the Relative Strength Index (RSI) is approaching the overbought region.

The blend of fundamental and technical aspects paints a picture of USD/JPY stabilizing after a decline, supported by Japanese importers and a rebound in US yields. The anticipation of a busy month-end Tokyo fix adds to the market dynamics. While bullish range momentum is evident, overbought conditions and the nearing overbought region on the RSI warrant caution.

Key Levels to watch are 146.560,145.682,146.161,145.956

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 145.682 | 146.534 |

| Level 2 | 145.417 | 146.958 |

| Level 3 | 145.097 | 147.018 |