GBP/USD Gains Ground in Asia Amid Broad Dollar Weakness and Lower US Yields

During the Asian session, GBP/USD managed to secure modest gains, advancing by 0.2%, as the U.S. dollar exhibited widespread weakness. The pair opened at 1.2601 and climbed to 1.2625. Market attention is intently focused on an array of upcoming data releases, including the U.S. August NFP report, PCE inflation figures, ISM PMI data, and the second estimate of Q2 GDP. These releases have the potential to influence rate expectations and subsequently impact the currency pair. Notably, with a UK bank holiday and the forthcoming U.S. Labor Day weekend leading to thin trading volumes, the hawkish sentiment expressed by BoE’s Broadbent at Jackson Hole has provided support to the GBP.

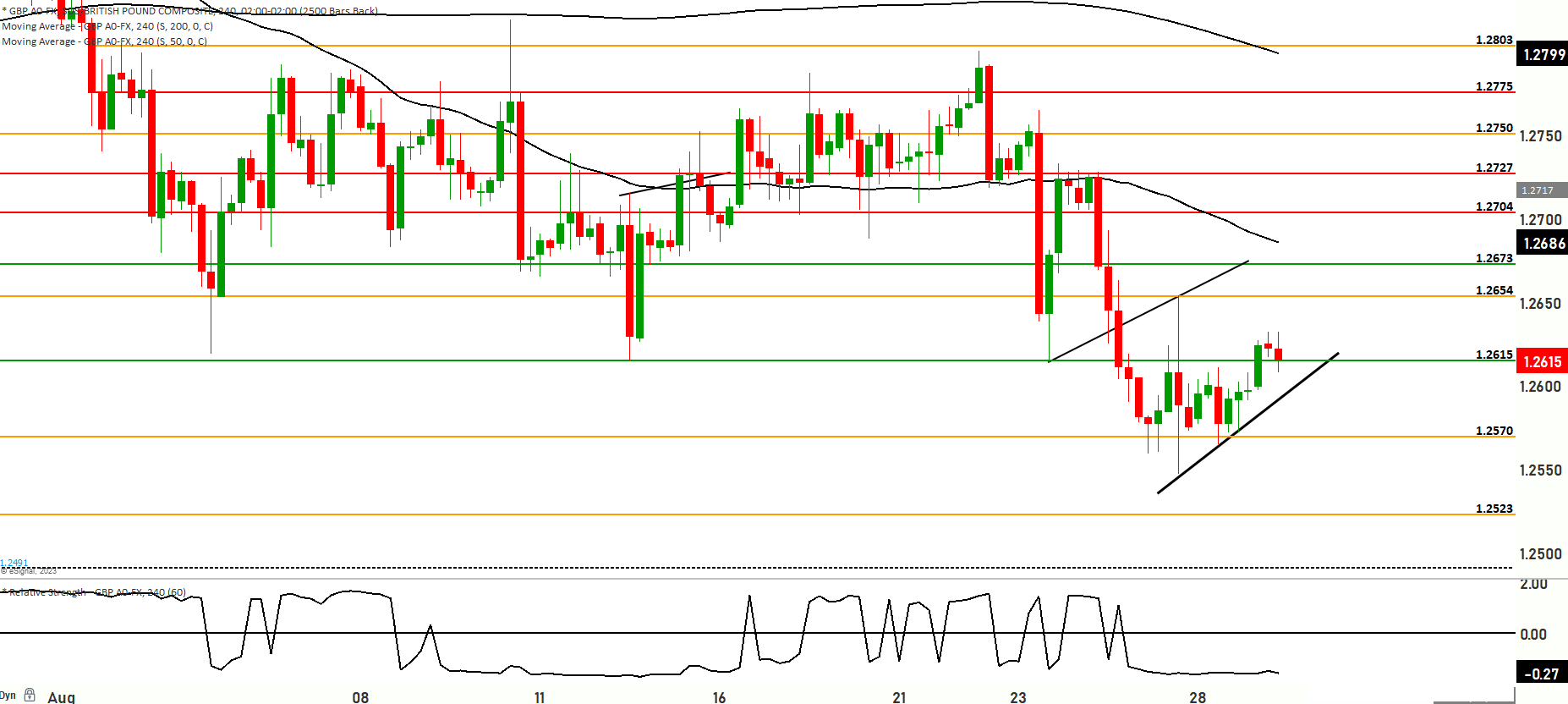

The price of GBP/USD is currently experiencing a short-term bullish uptrend, with the pair testing support levels at 1.2623. However, it’s important to note that the price remains below the 200-day and 50-day moving averages, signifying an overall bearish market sentiment.

Scenario 1: Bullish Momentum If the upward movement continues, the price might test the 1.2654 level and potentially reach upper levels around 1.2673. Further bullish momentum could lead to a test of the resistance at 1.2727, which serves as the topmost level of resistance.

Scenario 2: Bearish Correction On the other hand, if the price retraces from its current levels, it could find support around the 1.2598 level, possibly extending down towards 1.2570. If this support level does not hold, a further decline might bring the price to test the 1.2545 and 1.2525 levels, with 1.2523 acting as a significant support point.

The short-term momentum for the pair is currently leaning towards bullish territory, but it’s important to note that the RSI is indicating oversold conditions.

The GBP/USD pair saw gains during the Asian session due to the broad-based weakness of the U.S. dollar. Upcoming data releases are likely to steer rate expectations and influence the pair’s direction. The short-term bullish uptrend, despite the price being below key moving averages, suggests a potential upward movement.

Key Levels to watch are 1.2570,1.2615,1.2523,1.2654,1.2673

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1.2600 | 1.2654 |

| Level 2 | 1.2570 | 1.2673 |

| Level 3 | 1.2550 | 1.2704 |