Silver Price Analysis: CPI Data-Induced Bearish Sentiment and Ranging Dynamics

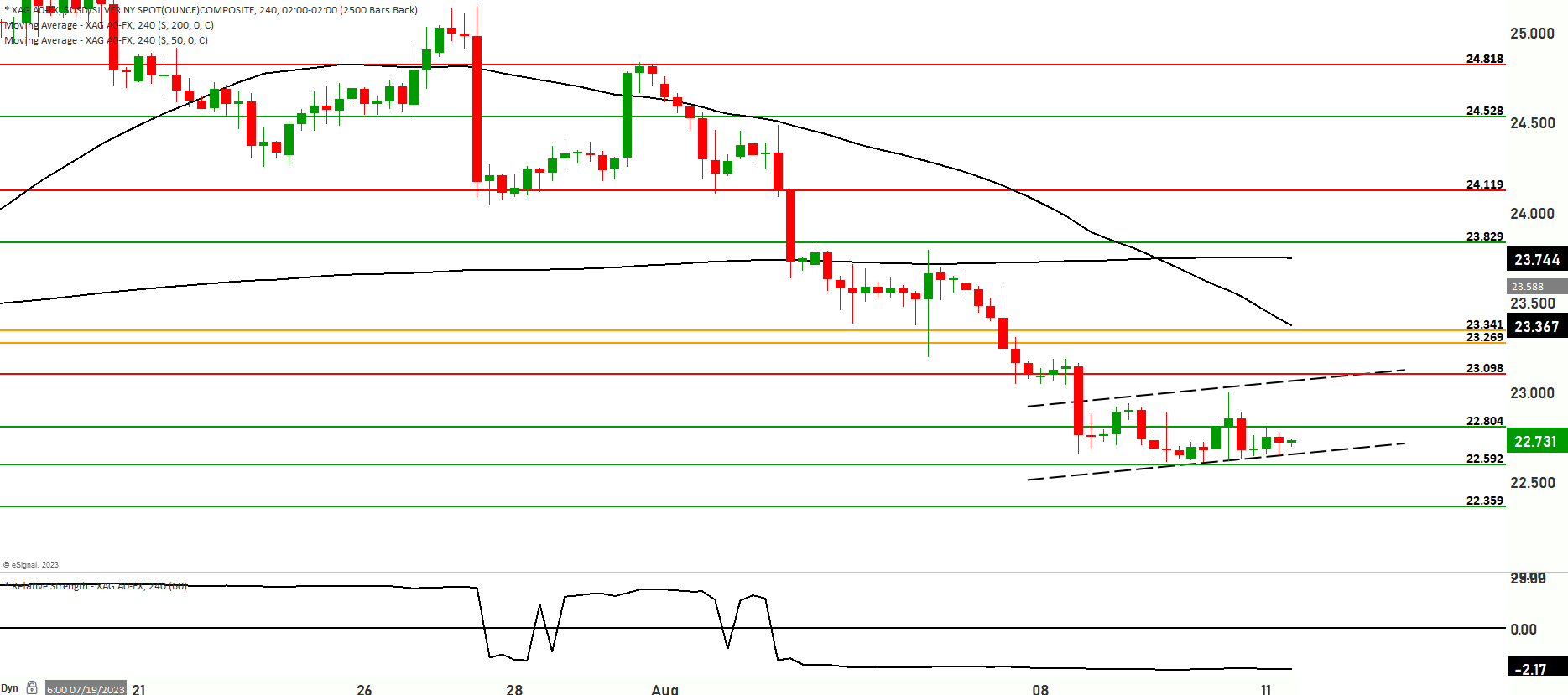

The silver market has been notably influenced by the recent release of U.S. CPI data, resulting in a volatile U.S. session. As the dust settles, the current outlook for silver reveals a prevailing bearish sentiment within a defined range. The current price stands at 22.660, encapsulating the intricate dynamics at play. Caution is paramount, given the potential for ranging between 22.592 and 23.829. The market’s response within this spectrum becomes pivotal in determining the path forward. The current price of silver aligns with a bearish stance, with its value positioned below both the 50-day and 200-day Moving Averages. This configuration underscores the overarching bearish sentiment that has been influencing recent market behavior.

Scenario 1: Downside Potential: Within this intricate landscape, one scenario unveils the potential for further decline. A conceivable movement towards the 22.592 level is plausible, with successful testing possibly paving the way for a continuation towards the 22.474 level. Of particular importance is the pivotal support level at 22.359, bearing significance for monitoring potential price dynamics.

Scenario 2: Upside Movement: In contrast, an alternative scenario envisions an upward trajectory from the current price. A retest of the 22.804 level is possible, accompanied by the potential encounter of resistance at 22.861. The prospect of further upward momentum beckons, with the 22.980 level beckoning as a potential target, followed by the significant 23.098 level. An uppermost resistance stands at 23.341, warranting particular attention.

CPI Data Impact: The volatile U.S. session following the release of CPI data has instilled considerable fluctuations within the silver market. The CPI numbers, reflecting the pace of inflation, have influenced investor sentiment and trading decisions. The market’s response has reverberated through the bearish sentiment, further accentuating the range-bound dynamics.

As the confluence of factors unfolds, the market’s range between 22.592 and 23.829 looms large. The market’s behavior within this corridor will serve as a compass for its impending trajectory, making it a critical focal point for traders and investors. The CPI data’s profound impact underscores the dynamic interplay of economic indicators and market sentiment, emphasizing the necessity for a vigilant and adaptive approach to navigate the ever-evolving silver landscape.

Key levels to watch are 23.341,23.098,22.804,22.592,22.359

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 22.592 | 22.804 |

| Level 2 | 22.489 | 23.861 |

| Level 3 | 22.359 | 24.098 |