Gold Price Analysis: CPI and Inflation Data Influence on Direction of Trend and Range

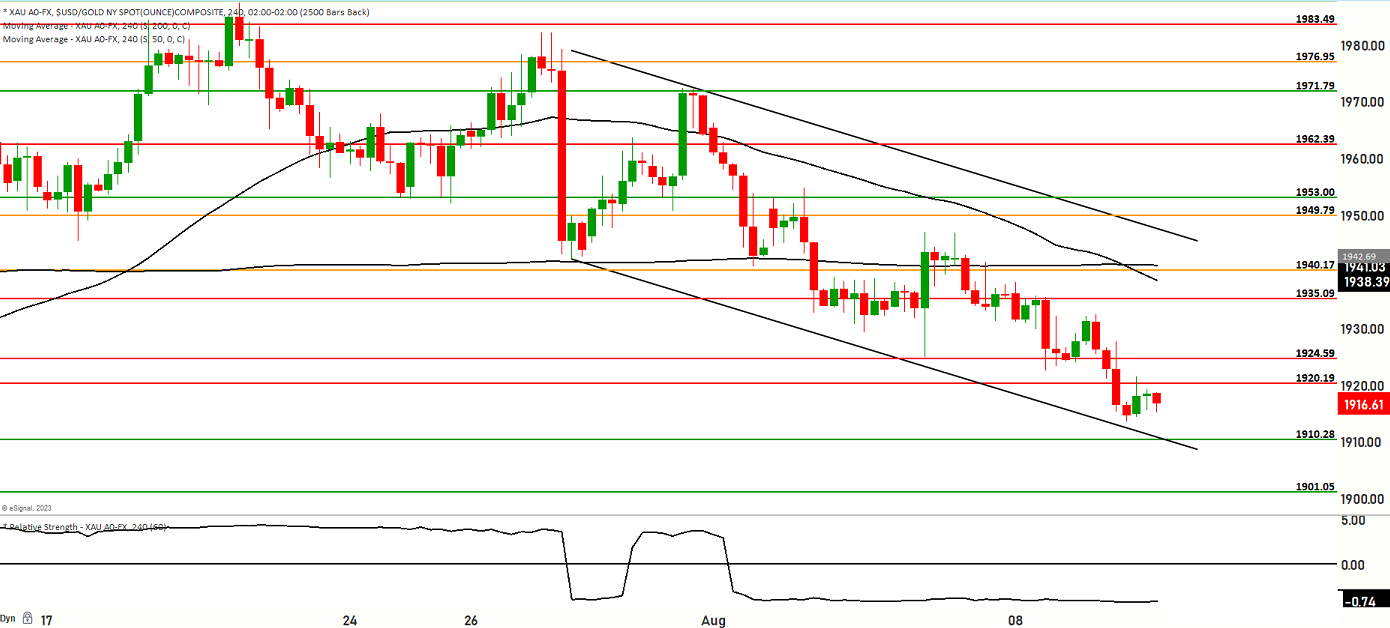

A series of high-impact events are on the horizon for today, including the US Inflation Rate, Initial Jobless Claims and CPI releases. This juncture bears immense significance for the gold market, as it currently grapples with a bearish trend within a range-bound context. Gold’s prevailing price trend aligns with a bearish trajectory, while concurrently existing below the 200-day and 50-day moving averages. Such a configuration instills a nuanced perspective, hinting at a bearish range-bound zone.

Scenario 1: Downside Prospects:

In the event of unfavorable CPI data, gold’s price might decline from its present stance. This potential decline could prompt a test of support levels, notably at 1911 and 1907. Furthering the bearish momentum, attention could then shift to levels such as 1904 and 1901. Subsequently, a more profound bearish sentiment might be observed at the significant 1892 level, acting as a formidable support threshold.

Scenario 2: Upside Potential:

Conversely, if the CPI data takes a positive turn, gold’s price could witness an ascent. This could result in a testing of resistance levels at 1924 and 1931. Continued bullish momentum might then propel the price toward challenging the 1935 and 1944 marks. A pinnacle resistance level emerges at 1950, signifying a crucial juncture for determining the direction.

CPI Data’s Impact on Gold:

The impending CPI data releases hold immense potential to sway gold’s price trajectory. Should the data reflect stronger inflation, potentially surpassing market expectations, gold might face further downward pressure due to its traditional role as an inflation hedge. Conversely, data indicating a moderation in inflation could potentially provide a reprieve for gold, alleviating the bearish sentiment. In light of these dynamics, it’s crucial for traders and investors to exercise prudence. The anticipated range for gold might span from the pivotal 1901 level to the 1940 mark, capturing the potential market fluctuations. Notably, the levels of 1950 and 1901 stand as pivotal determinants, holding the potential to steer the market’s trajectory – either perpetuating the bearish trend or prompting a reversal.

Key levels to watch are 1940,1907,1931,1924, 1901

| Levels | Support | Resistance |

|---|---|---|

| Level 1 | 1912.05 | 1931.80 |

| Level 2 | 1907.05 | 1940.00 |

| Level 3 | 1901.50 | 1944.00 |